August 15, 2025 /RBN Energy/Published by: Housley Carr—

The build-out of the Permian’s midstream infrastructure over the past 10 years has created extraordinary opportunities for startup companies, most of them backed by private equity. Each of us could cite several examples of midstreamers that, with a combination of guile and grit, developed gathering systems, gas processing plants, pipelines and other infrastructure to serve the fast-growing needs of producers and shippers. In many cases, the assets they constructed were later sold — often at a hefty profit — to much larger firms. As we discuss in today’s RBN blog, even in the midst of sector consolidation, the entrepreneurial spirit of smaller Permian midstreamers continues.

Who among us hasn’t watched with admiration (and maybe a little jealousy) as prescient developers in the Permian’s Midland and Delaware basins built out important sets of infrastructure over just a few years, then monetized their investments with eye-popping, lucrative sales to midstream giants and big-fish asset managers? Deals like Stonepeak Infrastructure Partners’ acquisition of Oryx Midstream; Targa Resources’ purchase of Lucid Energy Group; Enterprise Products Partners’ buyout of Navitas Midstream Partners; ONEOK’s takeover of the Midland portion of Medallion Midstream; and Morgan Stanley Infrastructure Partners’ purchase of Brazos Midstream. And don’t forget that just two weeks ago, MPLX announced an agreement to buy Northwind Midstream, a leading sour-gas gatherer/treater, for $2.375 billion.

You don’t need to squint to see the pattern here. In every case, the sellers were private-equity-backed midstream companies formed to pursue opportunities in the Permian and led by highly experienced, go-getting executives with a seemingly innate ability to identify which projects would be needed where and when. These midstream execs and their backers also had a knack for knowing when to sell. As we discussed in our Waltz Across Texas Drill Down Report in May, several large midstream companies — Energy Transfer, Enterprise, MPLX, ONEOK, Phillips 66 and Targa among them — have been expanding their Permian-to-Gulf-Coast networks for gathering, processing, transporting and exporting crude oil, natural gas and NGLs. Their ongoing competition to bolt on additional assets in key areas has made the mid-2020s a great time to cash in.

Sure, a lot of Permian infrastructure has already been developed, a lot of privately held midstream companies have sold what they built out, and still more deals are in the works. But it’s important to keep in mind that private-equity-backed midstream development continues apace, with a band of smaller private companies striving to duplicate what Brazos, Lucid, Medallion, Navitas, Northwind and Oryx achieved by seeking out opportunities to develop midstream assets that may well become attractive acquisition targets down the road.

In today’s blog, we’ll focus on one such up-and-comer. Producers Midstream, a portfolio company of Tailwater Capital, has been building a collection of midstream assets in the Permian’s Delaware Basin and Eastern Shelf — and the Anadarko — and recently (1) announced plans to expand its gas gathering and processing system in Lea County, NM, and (2) initiated an open season for an interstate pipeline project that would provide a new, northbound outlet for Permian-sourced gas.

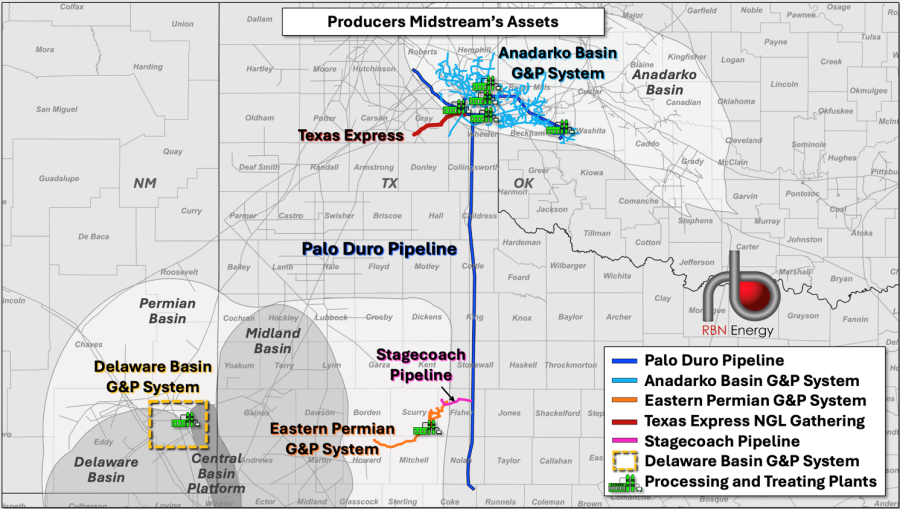

First, a little background. Producers Midstream II was formed in 2019 with backing from Tailwater to pursue midstream opportunities in the Permian. Its initial focus was the Strawn Sands region in the Permian’s Eastern Shelf on the periphery of the Midland Basin. In the heart of the Strawn Sands in West Texas’s Fisher and Scurry counties, Producers Midstream in 2020 completed a 70-mile gas gathering system (orange lines in Figure 1 below) and the 60-MMcf/d White Wing gas processing plant (green plant icon at lower-center). The following year, the company added a nitrogen-rejection unit (NRU) at White Wing and continued expanding the gathering system to its now 160-mile network of low and high pressure pipelines. (See It’s a Gas Gas Gas for more on nitrogen rejection in the Permian.)

Also in 2021, Producers Midstream acquired Midcoast Energy’s Anadarko Basin assets, which included about 3,200 miles of gas gathering and trunk pipelines straddling the Texas Panhandle and Oklahoma (light-blue lines in Figure 1); several gas processing plants (green plant icons at upper-center) with a combined 870 MMcf/d of capacity; the 310-mile Palo Duro gas transmission pipeline (north/south portion of dark-blue line) that runs between the Strawn Sands and Anadarko production areas; and a 35% ownership interest in Texas Express Gathering (TEG; red line), a 138-mile NGL gathering system that connects Anadarko and Barnett shale processing plants to the Texas Express Pipeline to Mont Belvieu. Then, in 2022, Producers Midstream built and started up the 20-mile, 10-inch-diameter Stagecoach Pipeline (magenta line), which transports “rich,” NGL-saturated associated gas to the Palo Duro Pipeline, which in turn moves that gas north to the company’s underutilized processing plants in the Anadarko.

That brings us to more recent history. In October 2024, Producers Midstream announced plans to develop a new gas gathering, sour-gas treating and processing system in the Northern Delaware’s Lea County. The initial system (dashed gold box in Figure 1) — we’ll get to a newly announced expansion in a moment — was completed in Q2 2025 and includes 55 miles of gathering pipelines; treatment equipment for removing most of the gathered gas’s hydrogen sulfide (H2S), carbon dioxide (CO2) and nitrogen; 26,500 horsepower of high-spec compression; and a 60-MMcf/d gas processing plant relocated from Scurry County, TX. Producers Midstream also said it will be drilling an acid gas injection (AGI) well in Q4 2025 for the sequestration of the removed H2S and CO2.

[As we said last year in Underground and more recently in We Built This City, the eastern flank of the Northern Delaware (including parts of Lea County) offers some of the best rock in the Permian, with exemplary initial production (IP) rates for crude oil and lower gas-to-oil ratios (GORs) relative to the rest of the gassy Delaware. But this sub-area comes with a nasty complication: associated gas with high levels of H2S and CO2 that must be removed via amine treatment and disposed of, ideally via AGI wells.]

Producers Midstream announced July 22 that it has signed additional definitive agreements with a handful of Northern Delaware producers for long-term acreage dedications and volume commitments. As a result, it will be adding 23 miles of gathering pipeline and another 13,500 horsepower of gathering compression in Lea County, expanding that system’s processing capacity by half (to 90 MMcf/d) and starting up the new AGI well there, all by the end of this year. The company noted that more deals with producers are possible and that Producers Midstream has an additional 150 MMcf/d of gas processing equipment in the Texas Panhandle that could be relocated to Lea County if demand warrants.

Upstream and Downstream Connectivity to Palo Duro Pipeline

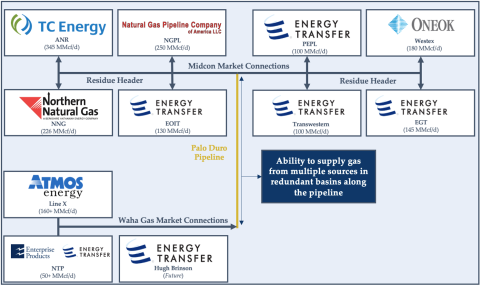

Speaking of the Texas Panhandle, Producers Midstream on June 30 initiated — and has since successfully completed — a 15-day, binding open season for firm transportation on an interstate gas pipeline project that, if developed, would provide new, northbound takeaway capacity from the Permian to new gas-fired power plants for Panhandle data centers and to the broader Midcontinent market. The Palo Duro Pipeline Project, as its names suggests, would combine 275 miles of the existing intrastate Palo Duro rich-gas pipeline between Nolan County, TX, and Wheeler County, TX, to leased capacity on the existing Palo Duro residue header system (east/west portion of dark-blue line in Figure 1) from Wheeler County into Oklahoma to create an interstate residue-gas pipeline. The pipeline would have an initial capacity of about 80 MMcf/d, possibly expandable to 160 MMcf/d with additional compression. If demand warrants, looping (installing a parallel pipeline) would enable further expansion, perhaps to as much as 320 MMcf/d or even 500 MMcf/d.

Producers Midstream said the repurposed and expanded Palo Duro Pipeline would interconnect with several Waha-area pipelines upstream (boxes to lower-left in Figure 2 above) and a long list of downstream interstate pipelines, including ANR Pipeline, Enable Gas Transmission (EGT), Natural Gas Pipeline (NGPL), Northern Natural Gas (NNG), Panhandle Eastern Pipeline (PEPL), Southern Star, Transwestern and WesTex Transmission (boxes in upper half of Figure 2). Palo Duro is “uniquely positioned to support growing demand from AI-driven power solutions and behind-the-meter power generation, in addition to easing bottlenecks that currently exist across traditional industrial, petrochemical, and power markets,” the company said in announcing the open season.

Producers Midstream is targeting a Q1 2026 in-service date for the project and filed an application with the Federal Energy Regulatory Commission (FERC) under Section 7(c) of the Natural Gas Act for the necessary authorizations.

Whether the Palo Duro project secures FERC approval and advances to a final investment decision (FID) remains to be seen. What is clear, however, is that Producers Midstream — and a number of other, smaller midstreamers like it — continue to stir things up by anticipating the need for a variety of new midstream projects. Their efforts help Permian producers and shippers keep pace with rising production and, if they play their cards right, also can make these midstreamers attractive takeover targets as the shale play’s midstream sector continues to consolidate.